And from Business Insider's data, vehicle insurance coverage companies tend to charge ladies more (vehicle insurance). Business Insider gathered quotes from Allstate and State Farm for fundamental protection for male and female drivers with a similar profile in Austin, Texas. When swapping out only the gender, the male profile was estimated $1,069 for protection each year, while the female profile was priced quote $1,124 each year for protection, costing the female motorist 5% more.

In states where X is a gender alternative on chauffeur's licenses consisting of Oregon, California, Maine, and soon New york city insurers are still figuring out how to compute expenses. Average vehicle insurance coverage premiums by age, The number of years you've been driving will impact the cost you'll spend for protection. money. While an 18-year-old's insurance coverage averages $2,667.

This information was offered to Business Expert by Savvy. How automobile insurance costs alter with the number of automobiles you own, In some methods, it's logical: the more cars you have on your policy, the greater your cars and truck insurance coverage bills. cheaper cars. However, there are likewise some cost savings when numerous vehicles are on one policy.

Automobile insurance coverage is more affordable in zip codes that are more rural, and the exact same holds true at the state level. Insure. com information shows that Iowa, Idaho, Wisconsin, and Maine have the most affordable automobile insurance of all states, and that's because they're more rural states. Other aspects that can impact the cost of car insurance There are a couple of other elements that will add to your premium, consisting of: If you do not drive numerous miles each year, you're less likely to be associated with a mishap (cheapest car).

Each insurance business looks at all of these aspects and rates your protection in a different way as a result. Get quotes from several different auto insurance companies and compare them to make sure you're getting the best offer for you.

The typical annual cost of automobile insurance coverage in the U.S. insured car. was $1,057 in 2018, according to the most recent data readily available in a report from the National Association of Insurance Coverage Commissioners. Knowing that fact won't necessarily assist you figure out how much you will be paying for your own coverage.

5 Simple Techniques For Arizona Auto Insurance Rates Rising On Heels Of Covid

To better comprehend what you need to be spending for vehicle insurance coverage, it's best to find out about the way business determine their rates. Keep checking out for an introduction of the most typical factors, and how you can earn a few extra cost savings. Determining Typical Yearly Cars And Truck Insurance Cost There are a great deal of aspects that go into identifying your automobile insurance coverage rate - insurance.

Here are some essential factors that affect the typical cost of cars and truck insurance in America.: Guys are usually considered riskier chauffeurs than ladies. The data reveal that ladies have fewer DUI occurrences than males, in addition to less crashes. When females do get in a mishap, it's statistically less most likely to be a serious accident.

The stats bear that out, with married people getting in fewer accidents. As a result, married individuals minimize their rates. Something less obvious is at play here, too; if your state mandates particular requirements for car insurance coverage that are more stringent than others, you're likely to pay more money. Michigan, for instance, requires locals to have limitless lifetime individual injury security (PIP) for accident-related medical expenditures as a part of their car insurance coverage.

The 2nd least costly state was Maine, followed by Iowa, South Dakota, and Idaho.: If you are using your car as an actual taxi or driving for a rideshare service, you will need to pay more for insurance, and you might need to spend for a various type of insurance coverage completely.

, how frequently you use your car, why you utilize your cars and truck, and where you park all effect your premiums. If you drive more frequently, you're exposed to the threats of the road more regularly. cheapest car.

: This one should be pretty obvious. If you have a history of racking up tickets, you are a riskier chauffeur to guarantee, and you will pay more in premiums. Installing tracking software on your lorry could help lower your premiums when you have a less-than-perfect history.: That incredibly smooth cars you've constantly desired? It's not simply going to cost you the price tag: driving an important automobile makes you riskier to guarantee. cars.

The 10-Minute Rule for What Is The Average Cost Of Auto Insurance? - Moneygeek

Insurance premiums likewise represent the general safety of an automobile and the average expense of repairs. If you're looking to minimize insurance coverage, purchase a minivan, a practical sedan, or an SUV. You must likewise consider buying an utilized cars and truck and installing anti-theft gadgets. It isn't just elegant cars that are often targeted by thieves.

You get what you pay forif you're in an accident, you'll probably be grateful you didn't select this as an area to scrimp and conserve on. On the other hand, if you never ever require to make a claim, you'll have swiped the additional savings without repercussion.

You currently understand that not all coverage levels are developed equal, but up until you head out and see what's readily available, you will never ever know whether you're getting the finest offer for the amount of coverage you want.: Are you a straight-A trainee? Active service in the military? An AAA member? These are simply a few of the qualities that might make you qualified for a discount rate on your insurance premium.

: You might get a discount rate for getting different types of insurance coverage through your auto insurance coverage company, such as home or rental insurance. cheapest auto insurance. Ask an agent what other insurance is available and whether you 'd get a discount for bundling the coverage.

It turns what you pay for car insurance does, too (cheap auto insurance). According to the information from online insurance coverage broker, a representative 40-year-old male with a clean record who completely insures a typical 2020 car would pay about $1,100 a year in Maine or New Hampshire.

That variety, of more than two-and-a-half times, in fact surpasses the range in various costs that Americans pay for gas depending upon location. Gas rates vary from a low of $1. 51 to simply under double that at $2. 87. Why such differing costs to guarantee a lorry depending on the state? Prospective aspects include the states' particular insurance coverage requirements, theft and insurance-fraud data, portion of chauffeurs who are uninsured, and incidence of bad weather that harms cars and trucks, such as hailstorms.

How Much Does Car Insurance Cost? - Lemonade Fundamentals Explained

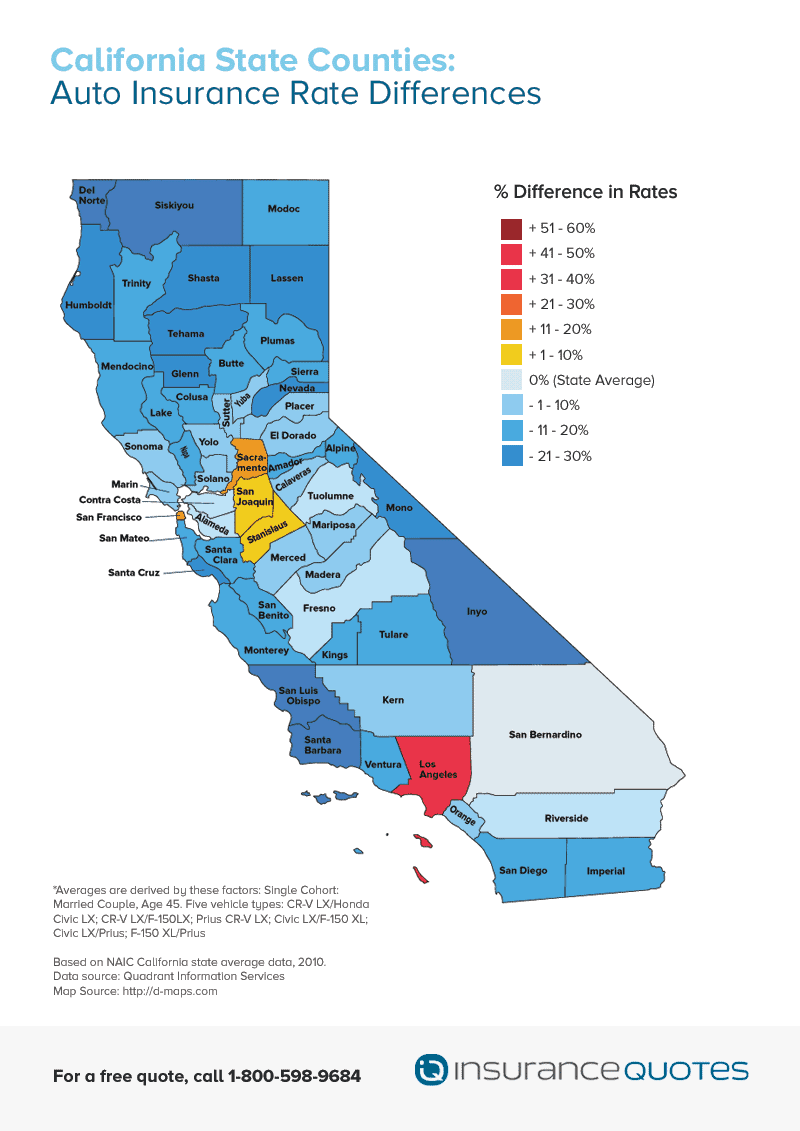

(For more on how this data was gathered, see the methodology at the bottom of the story.) Of course, our data disappears than a comparative photo of complete insurance on a new vehicle; your insurance expense will inevitably vary from our figures. vehicle insurance. Even within a state, rates differ according to the city or county where you live.

Click below to discover more. The Michigan reforms include decreases in needed liability protection and steps to lower the variety of uninsured chauffeurs on the state's roadways with 20% of chauffeurs without insurance coverage, Michigan ranks well above the nationwide average of 13%. Two other states on the list likewise have uncommonly high proportions of uninsured motorists: Florida at 26%, the greatest occurrence in the nation, and the District of Columbia, at about 16%.

Underinsured chauffeurs can be expensive, too. For instance, Louisiana, which has the second-highest prices in the country, has such low state requirements for liability coverage that a drivers insurance coverage can fall brief if they're discovered responsible for a major accident. Just like uninsured driving, the expenses may once again be financed by the premiums of insured motorists.

That's a crucial factor that numerous of the states on this list are sparsely populated and rural - perks. Half of the top 10 states for inexpensive vehicle insurance, consisting of Iowa and Idaho, are below-average in their population density, according to USA.com, Maine and Vermont are likewise on that list, and Stacker publication computes that they are the most rural states in the country.

The rate consists of uninsured motorist coverage. The survey averaged rates in each state for the cheapest-to-insure 2020 model-year variations of America's 20 best-selling lorries as of Jan. 2020 and ranked each state by that average.

The automobile insurance coverage premium is strongly affected by your area or where you live. Insurer analyze details on locations where people are more than likely to submit claims to develop rates. Amongst all the states,, a 19% boost in rates from 2020. On the other hand,, is the state with the least expensive vehicle insurance coverage rates.

The Only Guide for How We Calculate Auto And Car Insurance Premiums - Usaa

One of the factors automobile insurance coverage rates differ by state is that each state has its own insurance laws. Thus, making it the cheapest state for car insurance coverage.

The factor these states feature sky-high premiums varies; whatever from special insurance schemes, high-density populations, heaps of uninsured chauffeurs and costly claims will always press up premiums. When it concerns inexpensive states, the top 2 remained the very same, with Maine being the most inexpensive state in the country for car insurance coverage and New Hampshire coming in a close second.

In Maine, the typical premium is $858, which is 40% less than the nationwide average. In a little an abnormality, the average premium dropped from last year in the leading 5 least costly states, which may show that the coronavirus drove down insurance coverage prices last year as motorists remained at house - vehicle insurance.

Louisiana motorists are paying $1,981 more on average than drivers in Maine. The nationwide average this year can be found in at $1,428, which is a decrease of 6% from last year. In fact, rates dropped in nearly every state (it rose or remained the very same in nine states), which highlights how significantly COVID-19 affected car insurance rates.

Here are some of the aspects insurance companies think about: This ranking element is totally under your control and has a major impact on rates. Tickets, mishaps, and claims will always increase rates.

All of that leads to greater insurance coverage rates.

The How Much Does Car Insurance Cost On Average? - The Zebra Ideas

Studies reveal that males are more likely to act immature behind the wheel, leading to tickets, accidents, and claims. It's not just the state you reside in that can raise or lower your insurance coverage rates. Insurers will look at community information. High criminal activity or claim rates will result in a higher premium.

One of the factors automobile insurance coverage rates differ by state is that each state has its own insurance coverage laws. The average premium in Maine is $858, which is 40% less than the nationwide average. Hence, making it the cheapest state for car insurance coverage. Louisiana has an average insurance rate of $2,839 and it is 99% more costly than the nationwide average.

The factor these states feature sky-high premiums differs; everything from unique insurance plans, high-density populations, lots of uninsured motorists and costly lawsuits will always press up premiums (vehicle). When it pertains to low-cost states, the leading 2 stayed the very same, with Maine being the most affordable state in the country for automobile insurance coverage and New Hampshire can be found in a close second.

In Maine, the typical premium is $858, which is 40% less than the national average. In a bit of an abnormality, the typical premium dropped from in 2015 in the leading five least pricey states, which might indicate that the coronavirus drove down insurance coverage prices in 2015 as drivers remained at home. cars.

Louisiana drivers are paying $1,981 more on typical than drivers in Maine. The nationwide average this year came in at $1,428, which is a reduction of 6% from last year. In truth, rates dropped in nearly every state (it increased or stayed the exact same in nine states), which illustrates how considerably COVID-19 impacted automobile insurance rates.

A number of these risk elements are under your control, however some fall beyond your sphere of impact. Here are some of the aspects insurance coverage business consider: This rating aspect is completely under your control and has a major influence on rates. Tickets, mishaps, and claims will constantly increase rates. If you have numerous tickets over a short duration, you will be taking a look at a considerable boost and even a rejection of coverage.

Does Car Insurance Go Down At 25? - Experian for Beginners

All of that leads to higher insurance coverage rates. suvs.

Studies reveal that males are more likely to act immature behind the wheel, resulting in tickets, accidents, and claims. It's not just the state you live in that can raise or reduce your insurance rates. Insurance companies will look at neighborhood data. High crime or claim rates will result in a greater premium.