Review the complete Vehicle Club of Southern The golden state testimonial The Automobile Team The Automobile Club Team, or the Automobile Team, is one more AAA club that supplies car insurance policy along with other services such as financial and also traveling (accident). The Vehicle Team is among the largest of AAA's 25 clubs.

car insurance cheap auto insurance car insured perks

car insurance cheap auto insurance car insured perks

affordable auto insurance low-cost auto insurance cheaper car cheaper auto insurance

affordable auto insurance low-cost auto insurance cheaper car cheaper auto insurance

You must be a AAA member as well as live in one of the states AAA services to purchase protection. Allstate Allstate, an additional of the nation's largest insurance firms, uses a broad range of coverage alternatives as well as price cuts.

It offers a wide range of protections for vehicles in addition to other insurance items. Mercury insurance policy is marketed with independent agents and also is considered a no-frills insurance firm, which aids keep its costs reduced. Mercury provides an electronic-signature price cut if you sign your plan electronically. Mercury additionally offers rideshare coverage in numerous states, which is not a protection all insurance coverage business provide.

Farmers uses a variety of protections and enjoys to guarantee most automobile types including mobile homes, boats, jet skis, snow mobiles, motorcycles, ATVs, golf carts and also mobile home - insurers. Farmers supplies an alternative gas discount rate for lorries that are powered by anything apart from gasoline-only: hybrid, electrical, gas, propane - car.

insured car low-cost auto insurance affordable cheaper car insurance

insured car low-cost auto insurance affordable cheaper car insurance

USAA always ranks on top (or extremely near the top) in positions by third-party score firms. USAA managed a leading score from J.D. Power, an A++ monetary stamina rating with A.M. Ideal and our editors awarded it a 5. 0 (the only firm to achieve this) for their ordinary costs.

The Buzz on Car Insurance - Start A Free Auto Insurance Quote - Geico

Just Like State Farm, Erie is one of the a lot more flexible insurers when it concerns both speeding tickets as well as crashes. car insurance. Ideal auto insurance provider for auto-home package price cut Insurance provider supply a selection of price cuts to their clients, it can be a price cut for going crash cost-free for years, the security features in your vehicle as well for Have a peek here bundling your house owners and vehicle insurance coverage (auto).

Even if you don't own a house, numerous insurers will supply a packing discount if you also acquire occupants insurance from them. There are 6 standard types of vehicle insurance coverage and also relying on your car and financial circumstance you might not require to lug them all. But it is important that you are bring the best insurance coverages and also insurance coverage amounts for your certain needs.

Liability does not pay to repair your vehicle or for your clinical costs if you are wounded in the mishap. Responsibility coverage is required in virtually every state in the country so you will have to bring this insurance coverage. However state-required minimums are seldom sufficient in a major crash. It is best to consult your agent on ideal insurance coverage degrees.

This is not a lawfully needed protection, but if you have a finance or lease on your automobile your lending institution will certainly call for that you bring crash (vehicle insurance). If you are driving an older lorry that you would replace as opposed to fixing if you remained in a crash, you should drop this protection - auto insurance.

PIP is currently called for in regarding a lots states.: This insurance coverage will help cover the price to fix or change your vehicle if an uninsured or underinsured chauffeur hits you. It is required in 20 states as well as Washington, D.C. Even if you stay in a state that doesn't need this protection, you should consider it there are lots of without insurance drivers out when driving in addition to individuals who are only carrying the state minimums.

The 5-Second Trick For Usaa: Insurance, Banking, Investments & Retirement

It is just called for in 2 states, Maine, and New Hampshire. Everyone has various insurance coverage requirements, and also those needs can influence which insurance provider is best for you - insurance. Your situation and also insurance requirements are exceptionally certain, says Marlon Moss, certified agent with Learn as well as Serve. "Allow's claim you've had a couple of events in the past like a DUI or numerous moving offenses.

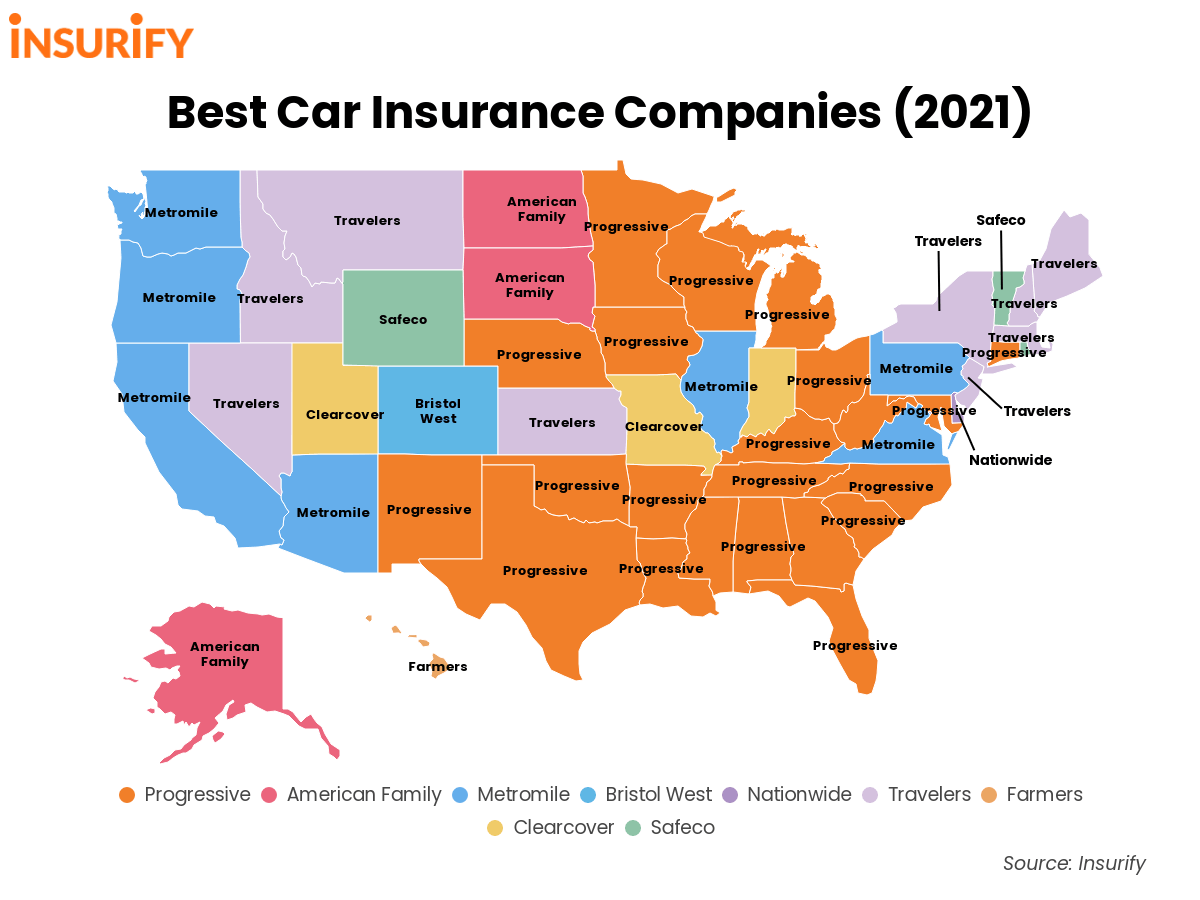

Establishing your certain demands will certainly aid you tighten down the carriers you must consider as well as the various protections you may need to carry. As our ratings above program, some insurance coverage companies only operate in certain states. Consider both nationwide insurers (ones that run in all states) in addition to more regional insurance provider that write policies in your state (money).

As soon as you have numerous quotes, it's time to compare them to find the finest insurer for you. vehicle. Here are a few tips on just how to contrast auto insurance policy quotes: Testimonial all the quotes to make certain they are precise. business insurance. Inspect to make certain the coverages you want are on the plan along with the correct deductibles (vehicle insurance).

If you locate an error, be certain to obtain it correct so you are comparing accurate rates. prices. Price cuts differ by insurance firm so some discounts might not be readily available on every quote. Validate all the discount rates on each quote as well as try to find others that might be missing out on. insurers. As an instance, if you are prepared to obtain your plan and also bills through email you may get approved for a paperless discount.

cheap auto insurance low cost low cost insurance

cheap auto insurance low cost low cost insurance

Compare the numerous premiums and determine which one supplies the insurance coverage you need at the price you can pay for. Cost should not be the only factor you consider. Claim fulfillment and customer solutions are essential factors to consider too. affordable. Methodology In order to make it very easy for customers to compare cars and truck insurer when buying coverage, developed a scoring system that rates insurers from 1 to 5 complete points.

Some Known Details About Eric Insurance Shares Tips For Riding A Motorcycle Safely

The typical price of vehicle insurance policy in 2022 for a 40-year-old driver with a great credit score as well as driving history is $1,724 for complete coverage, according to Insure. com research. This is the standard for a driver with a tidy driving document, if you have speeding tickets, accidents, or other relocating violations on your record, you will certainly probably pay dramatically extra for coverage.

Insurance firms generally lower costs around the age of 25. Stats reveal that vehicle drivers with lower credit report are most likely to sue so, if your credit rating is low, you will certainly pay more for insurance policy coverage. There are a couple of states that have outlawed the use of a debt rating when establishing a premium.

Urban drivers will certainly pay greater than country drivers since more crashes and claims take place in cities. Burglary prices are additionally taken into consideration in addition to weather. If you stay in a location that is susceptible to serious weather you will pay even more for coverage. The automobile you drive is a major rating element. cheapest auto insurance.

Insurance firms might need to change your car if it is ruined in a mishap, so the cost of your car is constantly thought about. Vehicle insurance can be complex, right here are a pair of one of the most typical misperceptions when it comes to vehicle insurance: In recent times rideshare driving as well as supplying food, grocery stores and also various other things have actually ended up being a side hustle for many individuals.