insurance companies money cheap liability

insurance companies money cheap liability

The actual cash worth of your auto is what it's worth in its current condition, or the quantity you might sensibly anticipate to obtain for it if you sold it today. It includes a reduction in worth for depreciation. And due to the fact that vehicles begin depreciating as quickly as you drive them off the whole lot, your car's ACV will be less than what you spent for it, also if it's not that old.

Replacement expense is how much you would certainly have to pay to get a new version of the same or a comparable lorry. It's greater than the ACV (cheap insurance). Because automobiles depreciate so quickly, it's simple to come to be inverted on a car financing or lease, particularly if you place little or no cash down.

It assists pay the difference between what your car deserves and what you owe the lending institution or leasing company - vehicle insurance. Many space plans also cover your collision or thorough insurance deductible. And also with space insurance coverage, you will not have to bother with whether the ACV of your car is high enough to pay off your finance or lease.

Discuss all your car's choices to make certain the appraiser recognizes everything included in your auto. low cost. Make sure to include upgrades or after-market items. "If you have evidence of various other cars that have actually offered in your location and also done your own study, you can present that to the insurer as well as have a conversation," Damico said.

cheap insurance low cost insurance cheaper car

cheap insurance low cost insurance cheaper car

If the quotes are similar, you may require to approve what the insurance policy business offers.

Excitement About What Happens After Your Car Gets Totaled

cheaper vehicle cheap car vehicle insurance

cheaper vehicle cheap car vehicle insurance

When you declare an insurance coverage case after being associated with a car crash, your insurer will identify your automobile worth prior to the accident. The major factor for doing this is to ensure that the insurance coverage business can determine whether your auto can be repaired or is a failure.

The actual cash worth (ACV) of your auto is the amount that your insurance provider will pay after your cars and truck is totaled in an accident or taken. Typically, your vehicle's ACV is its worth right before the mishap happened as figured out by your insurance coverage company minus all the deductibles you owe for your detailed or accident protection. insurers.

This is why the ACV insurance business create is generally hundreds or even thousands of bucks much less than the actual quantity you spent for the car. This applies also to the most cautious proprietors that have taken great care of their automobiles. You require to comprehend that cars and trucks depreciate in worth the min you drive them off the great deal, and this is why the depreciation has actually to be represented when calculating ACV.

This is in fact the major reason most car owners select to purchase extra protection for their automobile in case it obtains associated with a crash. A lot of car insurance provider around utilize distinct sector solutions to calculate your vehicle's ACV, which suggests that it is extremely hard to exactly forecast the amount they'll create in case your auto is totaled (risks).

An excellent surprise throughout this procedure is when the auto insurance provider pays a quantity that is exactly around what you approximated your vehicle deserved or perhaps extra than that. If the car insurance business comes up with an ACV which is way listed below what you think your car is worth, there is constantly area to challenge such an evaluation.

The 10-Minute Rule for How Insurance Companies Determine Market Value Of A Car

To contest this successfully, nevertheless, you require to show significant proof that your cars and truck would certainly have been worth a lot more in a reasonable market value than what they're providing you (laws). The most effective place to start is to look for similar vehicles marketed in your area. These vehicles have to be of the very same make and also version as yours, and they need to also have the same mileage, requirements, deterioration, and also mishap history.

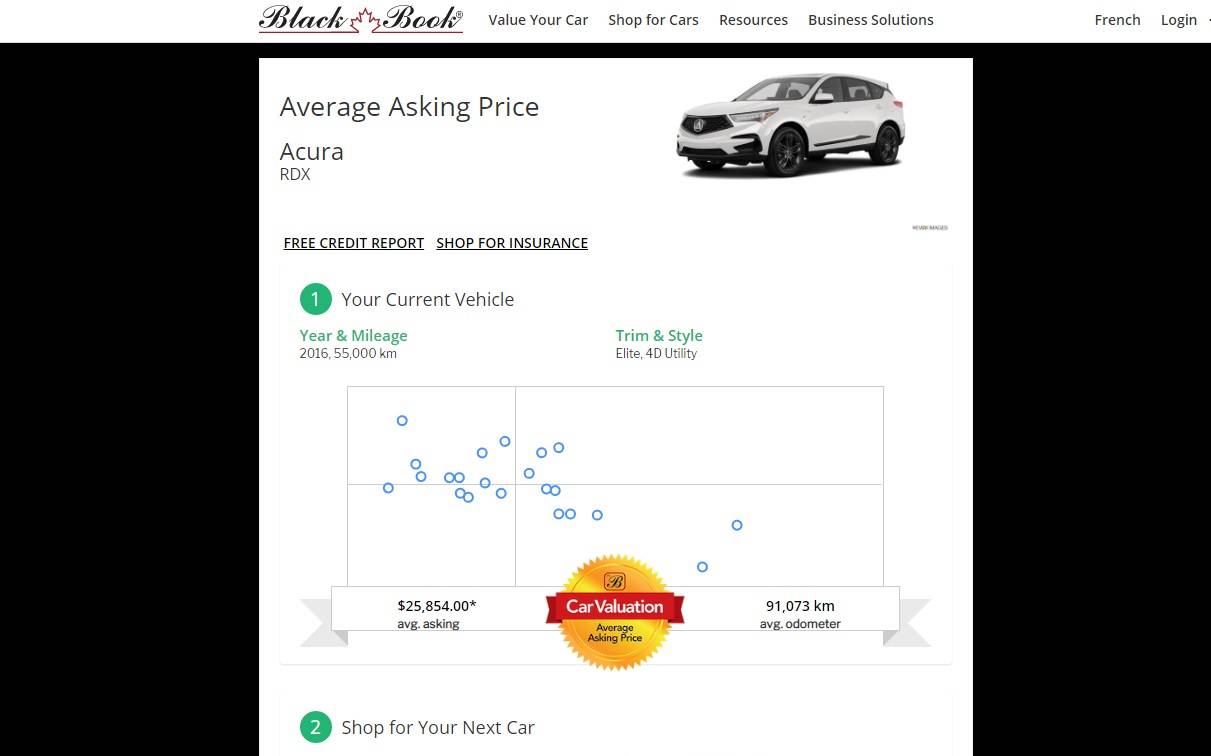

At this stage, you can additionally search for your automobile worth on internet sites such as Kelley Blue Publication as well as National Auto Dealers Association, which are both independent vehicle assessment firms - perks. You additionally require to put together some facets that clearly reveal that your car is worth even more than what the vehicle insurance provider is providing.

It's crucial to note that the cost of including each of them to your policy varies. Space insurance policy is usually more economical while brand-new auto substitute protection is extra costly, and also it could cost you concerning $120 greater than what you currently pay for your insurance policy yearly. Void Insurance Policy Insurance Coverage, If your vehicle is amounted to when the lease still isn't up or when you're still making financing settlements for it, you're still needed to continue making these payments despite the fact that you don't have the cars and truck anymore.

It will settle the distinction in between the quantity you owe in repayments for the automobile and the ACV. car insured. For the most part, you're required to obtain gap insurance policy coverage if you have an auto loan or you have actually rented an auto. Although gap insurance doesn't precisely get you a brand-new cars and truck, it offers you an add-on that that can aid you get one.

This insurance policy protection is only available for a cars and truck in which you're the very first owner and also it's a couple of years of ages. It's important to keep in mind that some of these specifics vary from one insurance policy provider to an additional. New substitute insurance protection makes certain that, if your auto is completed, you'll obtain compensation that is far more than the ACV of the auto.

Some Known Facts About Totaled Vehicle : After An Accident.

When your lorry is totaled in a crash, your insurer pays you for the value of the amounted to caror, a lot more precisely, it pays you what it claims the value to be. Virtually everyone who has been through this procedure can confirm that the most irritating component is approving the vehicle insurance provider's evaluation of your car's value.

laws trucks cheaper vehicle insurance

laws trucks cheaper vehicle insurance

In some cases, it is not even enough to cover what they still owe on the vehicle. insure. Amazing the issue is the fact that most clients are not familiar with the methodology made use of by insurance provider to value cars and trucks. The evaluation techniques of cars and truck insurance providers are mystical, counting on abstract information, the specifics of which they beware not to reveal.

Simply driving a new automobile off the whole lot drops it by as high as 10%, as well as devaluation accelerates to 20% by the end of the first year, according to Edmunds. com. Undoubtedly, the insurer dings you for every little thing from the miles on the odometer to the soft drink stains on the upholstery built up throughout that year.

Unless you agree to supplement the insurance coverage settlement with your very own funds, your next cars and truck is going to be an action down from your old one. Replacement Cost Insurance coverage An option to this problem is to buy vehicle insurance that pays the replacement price. This kind of policy utilizes the exact same technique to complete a car but, after that, it pays you the present market price for a brand-new car in the exact same class as your damaged car.

liability vans cheap prices

liability vans cheap prices

Vital If you total your vehicle soon after acquiring it, you could wind up with adverse equity in the auto, relying on your funding deal. insurance companies. That is, the insurance coverage settlement could be much less than you owe on the automobile. When Appraisal Falls Short The circumstance can worsen if the car is reasonably brand-new.

Our What Is Insurance Total Loss Car Value? PDFs

This might occur if you trash Helpful hints a brand-new auto soon after buying it. cheap auto insurance. A new auto takes its biggest appraisal hit when its brand-new owner drives it off the whole lot. If an accident takes place within a year or two, it's most likely that the payoff for the amounted to auto will certainly be much less than the proprietor owes on it.

Trick Takeaways If your cars and truck is amounted to in an accident your insurance provider will pay you it's actual money worth. Actual money value describes the insured worth of your cars and truck, which represents depreciation in time, along with any type of damages or deterioration. If you differ with the insurance coverage business's appraisal of your completed vehicle, you may be able to challenge it - perks.

What is the ACV of my cars and truck? The real money worth (ACV) of your cars and truck is the amount your insurance coverage firm will certainly pay you after it's stolen, or amounted to in an accident. Your automobile's real money value is different from what you spent for the automobile when you acquired it, which is called its retail worth.

After that, your insurer will reimburse you for your auto's real cash money value, minus your policy's deductible. car. Let's state the auto you've had for 5 years is amounted to and you have to make an insurance claim for the damage. Your insurer might identify that over the last five years, your cars and truck lost one third of its worth via devaluation and also deterioration.

In this scenario, your insurance policy firm would claim that your vehicle's ACV is $14,000, and you would certainly obtain a look for that quantity, minus your comprehensive or crash deductible. What is replacement expense vs. actual cash money value? Your automobile's substitute value is the quantity of cash that you would need to pay to replace it with a brand-new one after a complete loss.

The Best Strategy To Use For Total Loss Auto Claims With Your Insurance Company - Illinois ...

Even if your vehicle is just a couple of months old and also doesn't have several miles on it, it still beginning dropping as quickly as you drove it off the dealership's whole lot. What is the distinction between real cash value and fair market price? Your automobile's real cash value and its reasonable market price are different (car insurance).

You still have actually $20,000 entrusted to pay on your finance when you're in a crash and also complete your cars and truck. Your insurance policy firm figures out that the actual cash worth of your car is $15,000 (liability). Your insurance policy case will pay your $15,000, minus your deductible of $1,000. If you had gap insurance, it would cover the remaining $6,000 between your insurance policy payment and also the rest of your finance.

New auto replacement coverage indicates that, if your vehicle is totaled, you'll be used sufficient to replace your broken vehicle with a brand-new automobile of a the same or equivalent make and version. Some insurance coverage firms even supply coverage that will certainly pay to change your amounted to vehicle with one that's a couple of model years more recent.

Exactly how to challenge your insurance coverage firm's appraisal, After your insurance provider identifies your car's ACV as well as creates a negotiation, you have the option of challenging their deal if you assume it's too reduced (vehicle insurance). To do this, you'll need to show that your auto would certainly have been worth more at fair market price than you were offered.

To offer your research study much more integrity, seek autos at dealerships or through independent assessment companies, not cars and trucks that are offered over social media sites markets. Consider obtaining your vehicle evaluated: Obtaining your car appraised by an independent professional is a fantastic method to get a sense of its worth from a reliable resource.

Some Of How Do Car Insurance Companies Determine Car Value?

While these procedures may seem complex, your insurer might simply consider your dispute invalid if you don't adhere to the proper program of action. credit score. If your research shows that your insurer's appraisal is less than your vehicle's anticipated market worth and depreciation, you may be able to bargain with your insurance provider for an adjusted negotiation.

Some states have regulations that define this standard with a portion. accident. Once the cost of repairing your automobile exceeds the threshold, it's declared a failure. Will insurance pay for my car's retail or trade-in worth? Your insurer pays for your auto's retail worth. Your insurance coverage determines the worth of your cars and truck by determining just how much it would take for you to change it or purchase it.

Load full tabulation, The junkyards have plenty of them: wrecked as well as totaled automobiles that have met a regrettable end somehow (insurance). Losing a vehicle suddenly in a vehicle accident or all-natural catastrophe can be a discouraging as well as time-consuming thing, one you hope you never have to go with.